- Topmarq Dealer Weekly

- Posts

- Volume 01, Edition 21

Volume 01, Edition 21

Used Cars Cool Off, Record Dealer Profits

Greetings

It’s hot outside. So, grab a cool drink and take a few minutes to read the latest Dealer Weekly.

And speaking of cooling off, that’s what’s happening with used car prices. Depending on the data source, prices are flat or declining. In contrast, Penske Automotive is on fire with record Q2 profits.

We also take a look at steps to reduce consumer confusion about ADAS jargon and how the government wants to spend billions on semiconductor production.

Cheers!

Market A Glance

Forecasts hint at a return to normal

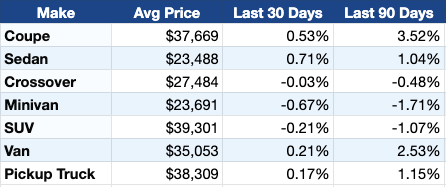

We’ll skip our deep dive into the CarGurus used vehicle price index but briefly share that the average pre-owned car sold for $30,946 (a $5 bump from last week). Instead, we’ll look at similar data from a different source.

The number crunchers at Cox Automotive report that the retail list price for a used car dropped to $28,012 from $28,312 at the end of May. On a yearly basis, that’s a 12% increase, which isn’t too far off from the near 11% figure quoted by CarGurus.

Regardless of whose digits you believe, the data is showing a return to normalcy in the second-hand market. If proven true, this could mean an uptick in demand for used vehicles, says the Cox report. The information even mentions a wholesale used market that “looks pretty normal.”

Breaking Headlines

J.D POWER reports that new vehicle sales contract, but transaction prices and dealer profits remain at record levels

Upstart Auto Retail named fastest growing digital retail software by Automotive Market Data

Ford expected to reveal next-gen Mustang at Detroit Auto Show

Mercedes-Benz Q2 Profit Increase Driven by Strong Demand and Favorable Model Mix

$51,500/ yr - The Average Car Salesperson salary in TX

Penske Automotive Scores With Record-Setting Quarterly Profits

Industry turmoil had little negative effect on Penske Automotive’s bottom line. The 150-store operation announced a record quarterly income of $374 million for Q2, a 10% YoY increase. Quarterly revenue dropped by 1% to $6.9 billion. Other Q2 earnings details include:

Retail Automotive Same-Store Revenue – decreased 8% (-3%)

Retail Automotive Same-Store Gross Profit – decreased 3% (+2%)

Retail Automotive Same-Store Variable Gross Profit Per Unit Retailed – increased $841/unit, or 16% (+21%), to $5,999

What’s In A Name? Confusion.

If your customer’s eyes glaze over upon the mention of the latest driver gizmos like CoPilot 360 or Honda Sensing, then a new industry effort may improve things. A coalition of the AAA, Consumer Reports, JD Power, the National Safety Council, Partners for Automated Vehicle Education, and SAE International recommends that automakers adopt standardized names for advanced driver assistance system (ADAS) technologies.

The action began in 2019 and was endorsed by the U.S. Department of Transportation as a way of better-educating consumers about what ADAS tech can and cannot do. Consistent terminology will help buyers compare apples to apples and limit the impact of hype.

There’s no word how automakers are responding to the voluntary measure, especially considering the investment in branding. But, the proposed changes are designed to work in tandem with manufacturers’ ADAS marketing.

Check out this handy summary of the group’s standardized terms.

Bill Seeks to Bolster U.S. Chip Industry

“I’m from the government, and I’m here to help” is an oft-quoted phrase from Ronald Reagan about the most feared words in the English language. But, that’s what the latest measure in Congress is seeking to do for U.S. semiconductor makers.

Under the CHIPS for America Act banner, the move strivest o lessen reliance on foreign semiconductor production. It will also seek to ease the burden that’s widely impacted the auto industry and other segments like consumer electronics and weapon systems.

The massive bill passed the Senate and will get a vote in the House. If passed, the legislation will offer $52 billion in federal subsidies for U.S. chip manufacturers and $24 billion in tax credits for expanded domestic manufacturing operations.

Give your dealership the upper hand with exclusive access to hundreds of consumer sellers in your area that you can't find on Craigslist or Facebook Marketplace.

Improve profit per vehicle with inventory direct from local consumers.

Focus on what matters with up to 5x higher lead-to-acquisition rate through our managed seller pipeline.

More potential buyers