- Topmarq Dealer Weekly

- Posts

- Volume 01, Edition 13

Volume 01, Edition 13

Prices Drop (Again) and a Bad Month for Asian Automakers

Good Morning,

Welcome to Topmarq Dealer Weekly, your quick read of industry news and happenings. This week, we cover the continued (but modest) slip in used car transaction amounts, the woeful dip in U.S. sales for Asian automakers, and how service department revenue is looking up.

Cheers!

Market at a Glance

Multi-week price drop continues

Crossovers and SUVs lead the charge

For the third consecutive week, the average used car transaction has dropped, according to CarGurus. It's not much of a decline, $30,756 compared to $30,770 from the previous week. It's too early to tell (and the amounts are too small) to call this a trend, so stay tuned.

Exploring the numbers shows that crossovers and SUVs (CarGurus separates the body style) lead the downward slide. We're talking less than a one percentage point fall over the past month (crossovers -0.28%, SUVs -0.59%), but it's an interesting twist in America's love affair with boxy five-doors. We'll continue to keep an eye on things.

Nissan Pulls the Plug on Ariya EV Sales

Head over to Nissan's U.S. website to order an Ariya EV, and you'll be greeted with a "Reservations are now closed" banner. It's a bummer for customers and dealers, as the automaker has suspended Ariya sales due to supply issues in Japan, where the all-electric crossover is built.

The timing couldn't be worse as the brand suffered a painful Q1 sales period. Nissan reported that January through March 2022 sales plunged almost 30% from the same time last year. There are bits of good news, though. Q1 LEAF sales increased by nearly 50% from 2021, but moving 4,371 units of the landmark EV does little to nudge the needle. Consumers did snap up more than 22,000 examples of the redesigned Frontier compact truck, but that represents a small fraction of the 189,835 vehicles sold by Nissan in Q1.

Perhaps Nissan dealers will see more traffic now that the drool-worthy 400Z is finally hitting the streets.

Nissan

Another Month and More Dealer Pain

And Nissan isn't alone in experiencing a substantial sales fall. Automotive News just delivered a bad report for Toyota, Hyundai, and Kia. Toyota's U.S. transactions of 175,990 units for May 2022 reveal a 27.3% drop from 242,171 sales in May 2021. Similarly, Hyundai saw 31.9% fewer customers last month (63,832, compared to 93,745 for May of last year). Sister brand Kia encountered its own tumble; May sales fell to 57,941 units against 80,298 sales from May 2021. It's the third consecutive monthly decline for these brands, thanks to the never-ending bane of supply chain woes.

But at the head of the pack (in not a good way) is Mazda, with a cringe-inducing 63.7% cratering of May sales. The company sold 15,312 units last month compared to 42,187 the year before. Even the company's May CPO sales declined by 26%.

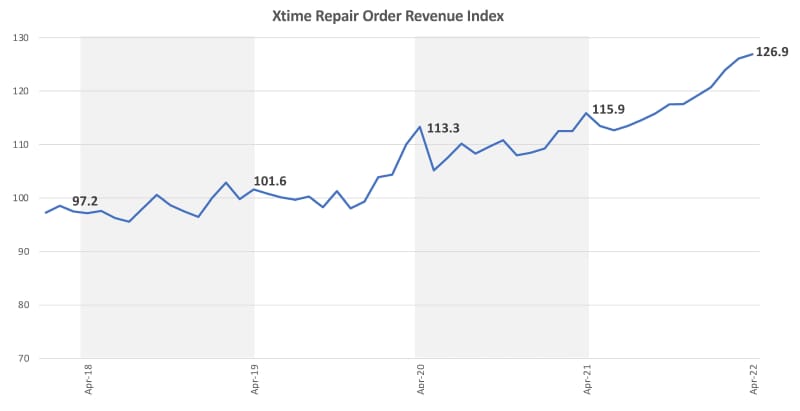

April Marks Record Service Revenue

It's not all gloom and doom in the car biz, at least for the service departments at U.S. franchised dealers. Cox Automotive reports that while April numbers show a 5.7% decline in repair orders from March, average per order revenue increased. Cox's Repair Order Revenue Index is up 0.7% from March and 9.5% year over year. It's the fifth consecutive monthly increase since November.

Cox Automotive

Dealer Essentials

Looking for more local inventory but tired of searching facebook marketplace & chasing down leads? Check out Topmarq's consumer platform to try the new way to source directly from local sellers.

Improve profit per vehicle with direct from consumer.

Increase close rate by up to 5x with our managed seller pipeline.

Start bidding in minutes.

Request access for your dealership today - Sign Up