- Topmarq Dealer Weekly

- Posts

- Volume 01, Edition 12

Volume 01, Edition 12

Kias Rise, Ford Pays $19M Fine, Podcast Guests Welcome

Good morning,

Welcome to Topmarq Dealer Weekly, your snapshot of industry news and happenings. Read on to learn about used car transactions, Cox Automotive’s history rewind and look into the crystal ball, and why Ford got hit with a $19 million wrist slap.

What stories do you like to read? Drop us a line with your feedback.

Cheers!

Market at a Glance

Used car prices drop again (OK, by just a few bucks)

Used Kias see greatest Y-O-Y increases

This edition’s look at used car prices via CarGurus reveals the second consecutive week of a price drop for the average transaction. The typical used vehicle now sells for $30,770, compared to $30,799 (a $29 fall). Curiously, the previous week’s decline was also $29. And that’s about as exciting as things get at this point.

In the meantime, let’s look at a few makes (in used form) for the most significant increase in prices year-over-year. Among brands still in production, Kia leads the pack, with second-hand prices jumping by 31.89% (the current average for a pre-owned Kia is $22,445). Mitsubishi followed with a 27.87% gain and an average transaction of $19,360. Rounding out third place is Volkswagen, with its used cars experiencing a 27.39% boost and a $22,655 typical selling price.

Has your dealership had to transition strategies to survive the pandemic? How are you positioning yourself to win as we return to normal?

Have strong opinions on the above? Apply to be a guest on our Podcast where we dive into the nitty gritty of managing a dealership in the modern market -> here.

Cox Automotive’s 2022 Market Insights and Outlook

There’s never a shortage of industry information provided by Cox Automotive, the company drills down into the details like few others. One way to easily take it all in is by checking out its 2022 Market Insights and Outlook report. Grab some coffee (or something stronger, depending on your point of view) and take 30 minutes to look at a recap of 2021 and where the auto business is headed this year.

The 33-page document explores new and used vehicle sales data from last year, auto loan originations and defaults, wholesale inventory challenges, service department data, and other interesting reads.

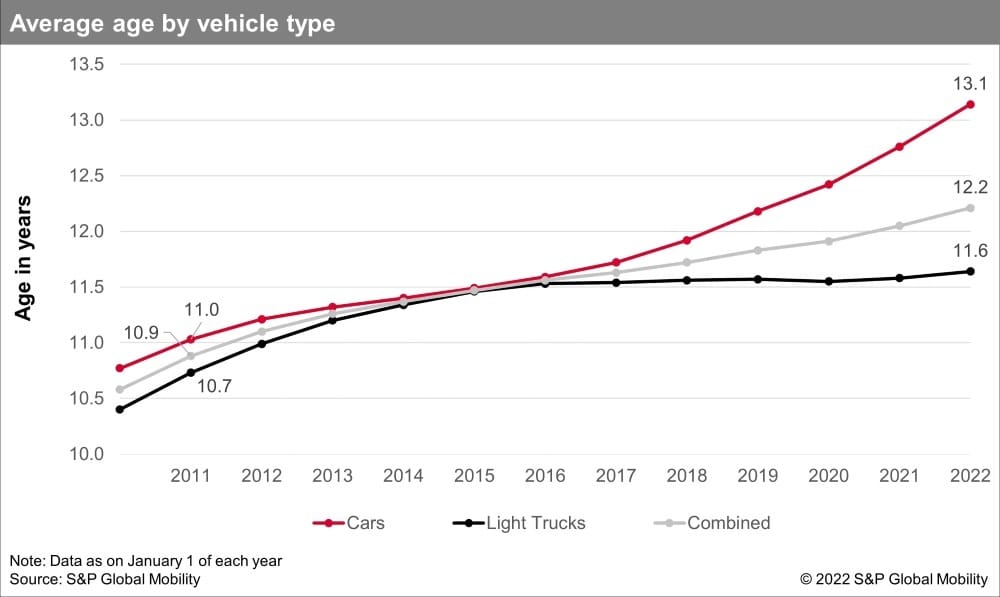

Average Age of Vehicles in the U.S. Increases to 12.2 years

The average age of America’s 283 million passenger cars and light trucks reached a record 12.2 years, according to a new report by S&P Global Mobility. That’s an increase of almost two months over the previous year. S&P Global Mobility is the new name for the automotive operations of IHS Markit. It’s the fifth consecutive year for the average U.S. vehicle to gain in age, even as the overall vehicle fleet grew by 3.5 million units.

The analysis restates the obvious that the pandemic, supply chain shortages, and inventory problems have led to more vehicles staying on the road for longer periods. But these often-anecdotal tales are backed-up by fundamental data; vehicle scrappage is at record lows. Last year’s scrappage volume was at 11 million, a 4.2% rate among all vehicles in operation. It’s the lowest in the past 20 years.

S&P Global Mobility

Ford Pays $19 Million Fine For False Advertising

Without admitting guilt, Ford settled with 40 states and the District of Columbia regarding allegations of overstating fuel economy projections and payload capacities for 2011-2014 Super Duty pickups and 2013-2014 C-Max hybrids. The automaker will make a $19.2 million multi-state settlement to resolve the matter.

“Consumers place a premium on fuel-efficiency when shopping for new vehicles. For years, Ford advertised impressive fuel economy and payload capacity for its cars and trucks,” Iowa Attorney General Tom Miller said. “Unfortunately, these figures were not based in reality, leaving customers with vehicles that did not meet their standards.” Iowa spearheaded the action on behalf of the other jurisdictions.

Dealer Essentials

Looking for more inventory? Tired of searching facebook marketplace & chasing down leads? Check out Topmarq's consumer platform to see the new way to source directly from local sellers.

Improve profit per vehicle with direct from consumer.

Increase close rate and buy more vehicles, faster with our managed seller pipeline.

Start bidding in minutes.

Request access for your dealership today - Sign Up